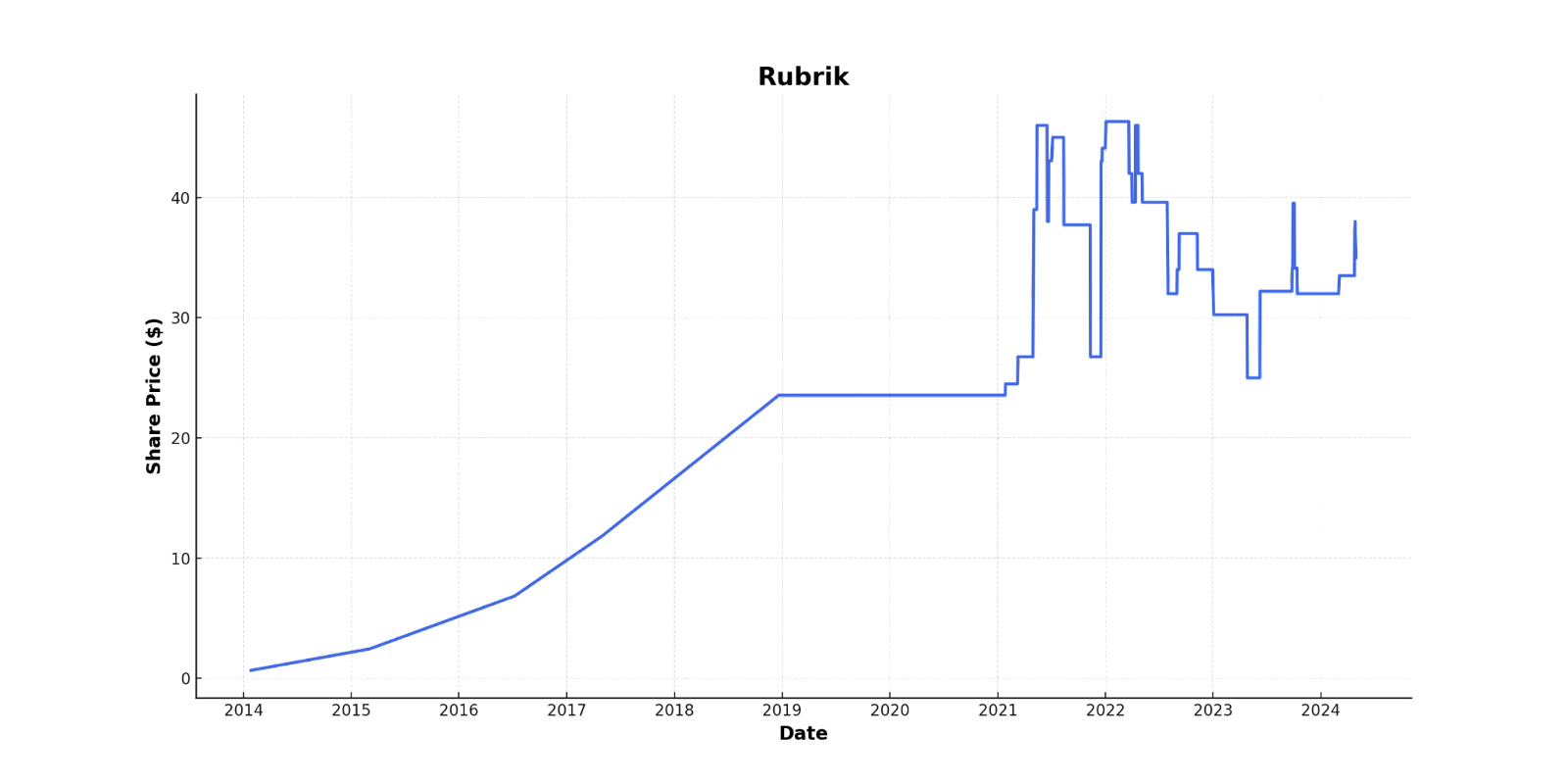

Rubrik, a Prime Unicorn Index component, made its public market debut last Thursday, April 25, priced at $32 per share, above its expected range of $28 to $31. The company closed its first day of trading at $37 and is trading near $35 at the time of writing. This marks the third Prime Unicorn Index component to go public in the past year, behind Instacart and Astera Labs. All of these are actively trading above their IPO price.

Rubrik, a cybersecurity startup, had previously raised $667 million. Its most recent round was a Series, which priced the company at nearly $3.1 billion, according to data collected by the Prime Unicorn Index. Investors include Greylock, Khosla Ventures, IVP, Bain Capital, Lightspeed, Microsoft, and Greycroft.

Rubrik raised $752 million in its IPO, giving it a roughly $5.6 billion valuation. According to WSJ, the company reported a net loss of $354 million last year. However, after shifting exclusively to a cloud-based platform in 2022, Rubrik experienced substantial growth in its annual recurring revenue (ARR), increasing from $599.8 million to $784 million by the fiscal year ending January 31, 2024.

Despite broader challenges in the cybersecurity sector, evidenced by Wiz’s acquisition of Lacework and funding reductions to less than half of 2021 levels, Rubrik’s IPO demonstrates that the market remains accessible to companies that exhibit a clear route to profitability. According to Bipul Sinha, Rubrik’s CEO, “If you have a durable business with a path to profitability and a differentiated product in a sufficiently large market…the market is definitely receptive.”

See how Rubrik has performed below.