Prime Unicorn 30 Index Performance and Market Insights

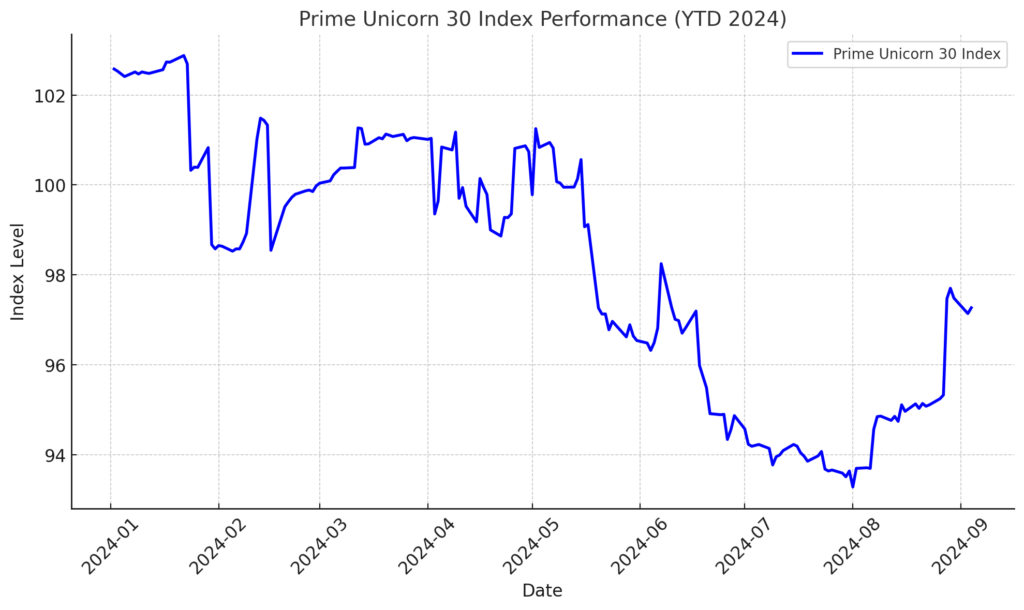

The Prime Unicorn 30 Index has seen notable fluctuations over the past 12 months, declining by over 12% during a challenging period for private venture-backed companies. However, recent data suggests that the index may be stabilizing, indicating that we could be past the peak of the correction. Year-to-date (YTD), the index is down 5.18%, but in the last month alone, it posted a 2.64% gain, reflecting a potential recovery.

Factors Contributing to the Correction and Recovery

A key factor contributing to this shift is the performance in secondary markets, where private companies have been trading at a discount over the past year. Many of the companies in the Prime Unicorn 30 Index have seen their shares trade below their previous valuations in these markets, contributing to the broader correction. However, secondary market data from Caplight shows that this trend may be reversing. Secondary prices are up 56% over the last 12 months, and closed trade volume has increased by 50%. This resurgence in secondary market activity signals renewed investor confidence, which is likely contributing to the index’s recent recovery.

Another contributing factor is the reduction in down rounds across various funding stages. Normally, around 10% of venture funding rounds are down rounds, but this number spiked dramatically over the past year. Carta’s data shows that in Q1 2024, 42% of Series D rounds were down rounds, and Series C peaked at 36% in Q4 2023. These elevated levels of down rounds coincided with the downward movement of the Prime Unicorn Index during that time.

However, as of Q2 2024, the proportion of down rounds has started to decrease across Series A, B, C, and D. For example, Series D down rounds fell from 42% to 37%, while Series C dropped from 36% to 28%. This decline in down rounds suggests that the market may be recovering, and it’s no coincidence that the Prime Unicorn Index has responded accordingly.

While the market remains volatile, the combination of a reduction in down rounds, the strong rebound in secondary market activity, and the recent positive movement in the index indicate that we may be past peak correction territory. As we move through the remainder of 2024, it will be important to monitor whether this trend continues, potentially signaling more stability and a favorable environment for high-growth companies.

Public Companies in the Index

- Astera Labs:

- IPO Date: March 20, 2024

- IPO Price: $36.00

- High: $95.21

- Low: $36.22

- Current Price: $37.96

- Valuation: $6 billion

- Rubrik:

- IPO Date: April 25, 2024

- IPO Price: $32.00

- High: $40

- Low: $28.34

- Current Price: $30.37

- Valuation: $5.5 billion

Companies with Large Secondary Transactions

- SpaceX:

- YTD High: $104.00

- YTD Low: $86.00

- Current Price: $104.00

- Current Valuation: $162.5 billion

- Discord:

- YTD High: $230

- YTD Low: $205

- Current Price: $225

- Current Valuation: $6.4 billion

Companies with Notable Primary Rounds

- CoreWeave:

- Round Date: May 2024 (Series C)

- Round Size: $1.1 billion

- % Increase/Decrease: 598% increase from Series B

- Valuation: $17.9 billion

- Anthropic:

- Round Date: April 2024 (Series D)

- Round Size: $4 billion

- % Increase/Decrease: 167% increase from Series C

- Valuation: $18.1 billion

- Anduril:

- Round Date: August 2024 (Series F)

- Round Size: $1.5 billion

- % Increase/Decrease: 31.6% increase from Series E

- Valuation: $11.6 billion