Sequoia Capital, founded in 1972, is a globally renowned venture capital firm recognized for its significant role in empowering transformative companies across various sectors, including technology, healthcare, and consumer services. With its headquarters in Menlo Park, California, and offices worldwide, Sequoia specializes in investments at every stage and is known for its founder-centric approach, focusing on building long-term partnerships with ambitious entrepreneurs. The firm has backed several iconic companies such as Apple, Google, and Airbnb, contributing to their growth through strategic guidance and capital.

Sequoia has invested in many Prime Unicorn Index components. In this post, we will highlight some of these investments.

SpaceX, founded in 2002 by Elon Musk, is an American aerospace manufacturer and space transport services company known for developing the Falcon and Starship rockets and advancing the goal of reducing space transportation costs to enable the colonization of Mars. It has made significant strides in the commercial space industry, including developing reusable rocket technology and launching the first commercial astronaut mission to the International Space Station. SpaceX has raised over $6.5 billion, most recently raising a $1.9 billion Series N round in August 2020 at $27 per share, valuing the company at $42 billion. Previous investors include Sequoia, Google, Fidelity, Founders Fund, Valor Equity Partners, and others.

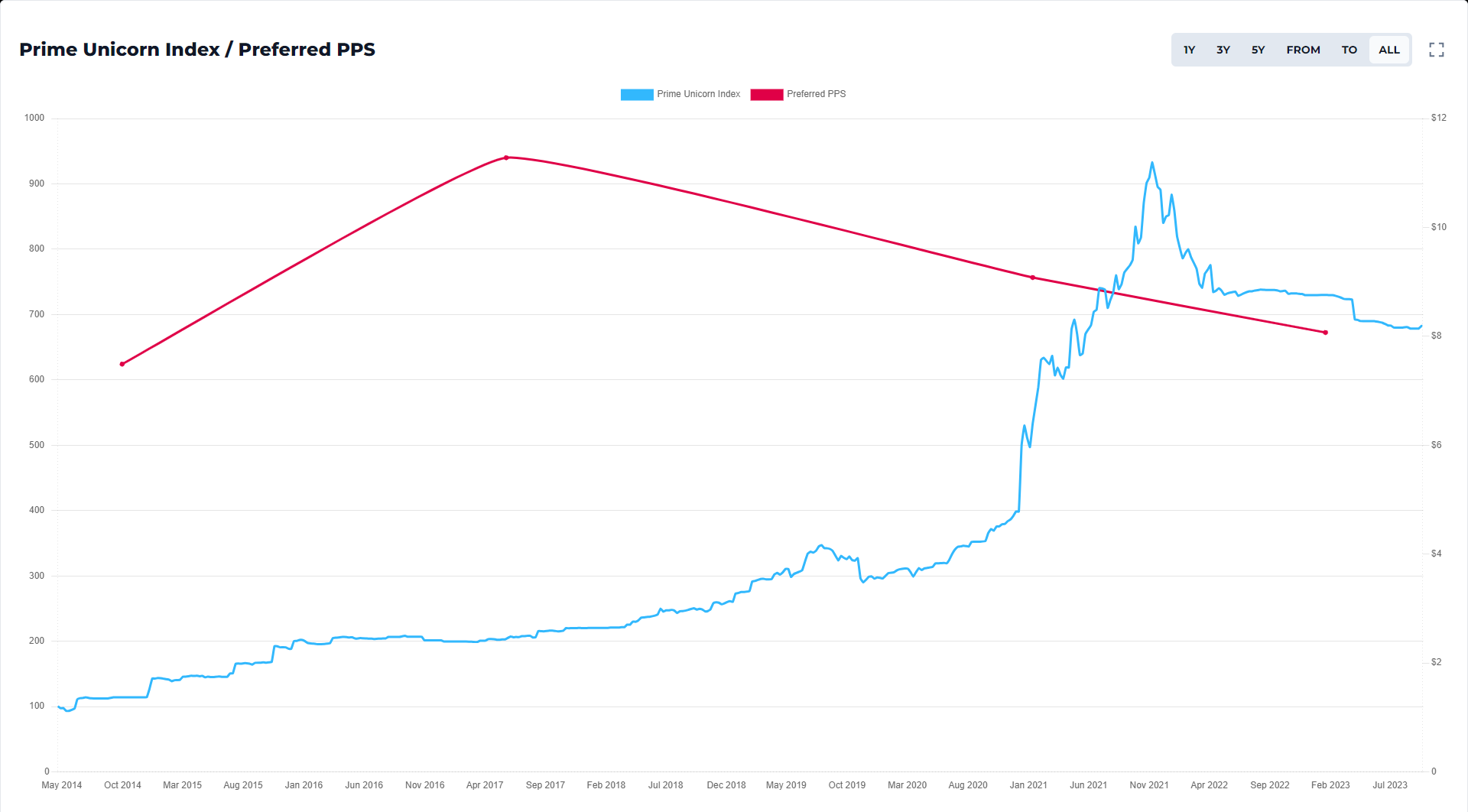

Houzz, Inc. is the leading online home remodeling and design platform, providing people with everything they need to improve their homes. It is also a Sequoia portfolio company and a component of the Prime Unicorn Index. Houzz has raised $598.24 million over five rounds, most recently raising $400 million in a Series E round in May 2017 at a preferred price per share of $11.28. This valued the company at $3.8 billion and included investors such as Sequoia, Zeev, and Wellington. Previous investors include Kleiner Perkins, T Rowe Price, Comcast, and others. Houzz has been marked down in the Prime Unicorn Index twice due to EPEN filings, with the company now valued at $3.1 billion following an EPEN in January 2023, which lowered its PPPS to $8.07.

Maplebear, Inc. (DBA: Instacart) offers a grocery delivery service that allows users to select groceries from items at stores like Whole Foods, Trader Joe’s, Safeway, and Costco via a mobile phone or the Web. Instacart most recently raised a Series I round in March 2021 at a preferred price per share of $125, valuing the company at $32.9 billion. However, since its last round, Instacart completed its IPO at a PPS of $30 on September 19, 2023. Previous investors include Sequoia, A16Z, Kleiner Perkins, D1, Fidelity, and T Rowe Price.

CaptivateIQ is a renowned software company specializing in commission solutions. It empowers companies to streamline their commission processes with automation, thereby reducing errors and enhancing efficiency. The platform is designed to offer flexibility, allowing businesses to manage commissions in a more transparent and timely manner, which is integral in motivating sales teams and fostering a more productive working environment. CaptivateIQ has raised $162.34 million over three rounds, most recently raising $100 million in a Series C round in January 2022 at a PPPS of $23.30, which valued the company at $1.1 billion. Investors in CaptivateIQ include Sequoia, ICONIQ, Accel, Sapphire Ventures, Y Combinator, Amity Ventures, and s28 Capital.