As the tech industry emerges from its IPO drought, this week marks a significant turning point with the launch of some of the first tech IPOs of 2024. Among them, Reddit and Astera Labs stand out as highly anticipated public offerings. Astera Labs, in particular, holds the spotlight as a Prime Unicorn Index component that went public yesterday. This event is not just a milestone for the company itself but also sets the stage for what could be a resurgence of tech IPOs. Bankers and industry insiders are already looking forward to a more active second half of 2024, with hopes pinned on the success of these initial public offerings.

Astera Labs, founded by Jitendra Mohan, Sanjay Gajendra, and Jay Rathour in 2017, has quickly made a name for itself in the tech world. The company specializes in developing purpose-built connectivity solutions for data-centric systems, with a particular focus on high-performance computing, cloud, and AI markets. Astera Labs’ offerings are designed to address the critical challenges of increased data and signal integrity requirements in these rapidly growing sectors.

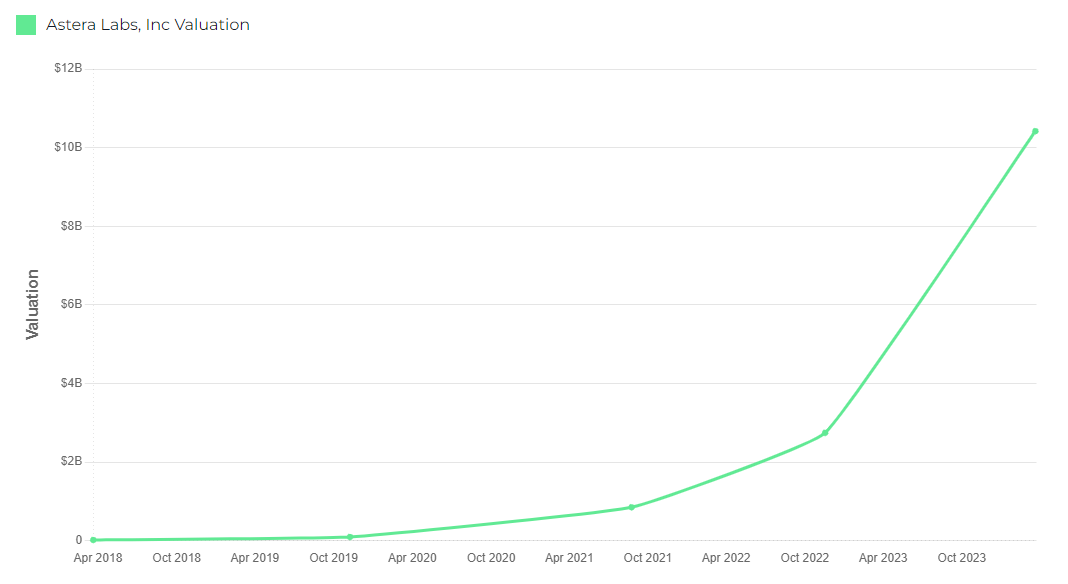

Astera Labs has raised a total of $234.5 million over four rounds, with its most recent funding round being a $150 million Series D, which was priced at $10.17 per preferred share. This round valued the company at $2.7 billion and included participation from Fidelity, Atreides, Sutter Hill Ventures, and Intel Capital.

Astera Labs’ IPO was priced at $36, above its expected range of $32-$34. On its first day of trading, the company soared 72%, closing at $62.03. At the time of writing, the stock had continued its rally above $70.

Interestingly, Astera Labs had not performed as well in the secondary markets leading up to its IPO. As recently as February 1st, 2024, the company was trading at $9.25 per share, according to Caplight data.

Let’s take a look at Astera Labs’ valuation leading up to its IPO.