Navigating the intricate realm of venture capital and high-growth tech investments, Fidelity, Wellington Management, and T. Rowe Price emerge as key players with unique approaches. This analysis delves into their distinct investment strategies, particularly their ’40 Act funds, and evaluates their performance against and exposure to the Prime Unicorn Index using data from our Benchmark platform.

Fidelity

Fidelity is renowned for its expansive portfolio, which often includes high-growth tech companies and startups. Its ’40 Act funds are tailored to investors seeking diversified exposure, including unicorn companies. Fidelity’s strength lies in its research-driven approach, offering a blend of risk management and growth potential.

Fidelity’s Investments in Active Index Components

- Thoughtspot

- SpaceX

- Juul

- Relativity Space

- Databricks

- Discord

- Magic Leap

- Astera Labs

- ASAPP

- Maplebear (DBA: Instacart)

- Somatus

- Freenome

- Nuro

- Algolia

- GoBrands (DBA: GoPuff)

- Gusto

- Lyra Health

- Yanka

- Carbon

Wellington

Wellington Management stands out for its comprehensive investment strategies. Their ’40 Act funds typically focus on long-term growth, with a keen eye on innovative tech startups. Wellington combines market insights with a forward-looking approach, potentially benefiting investors interested in emerging technologies and high-growth ventures.

Wellington’s Investments in Active Index Components

- Heartflow

- Houzz

- Faire Wholesale

- BetterUp

- Cityblock Health

- Magic Leap

- Attentive Mobile

- Synthego

- JRSK

- Greenlight Financial Technologies

- Lookout

T. Rowe Price

T. Rowe Price is known for its active management style and venture capital investments. Its ’40 Act funds often include significant positions in promising tech startups and have a reputation for identifying and investing in potential market leaders before they become mainstream.

T. Rowe Price’s Investments in Active Index Components

- Farmer’s Business Network

- Houzz

- Databricks

- Maplebear (DBA: Instacart)

- Color Health

- Magic Leap

- Gusto

- ServiceTitan

- Freenome

- Nuro

- Lookout

- Socure

- Seismic Software

- Datarobot

- Tanium

- Kobold Metals

- SpaceX

While all three firms provide venture capital exposure, they differ in their investment approaches. Fidelity excels in offering a broad mix, Wellington brings a strategic, long-term perspective, and T. Rowe Price focuses on identifying early winners in the tech space.

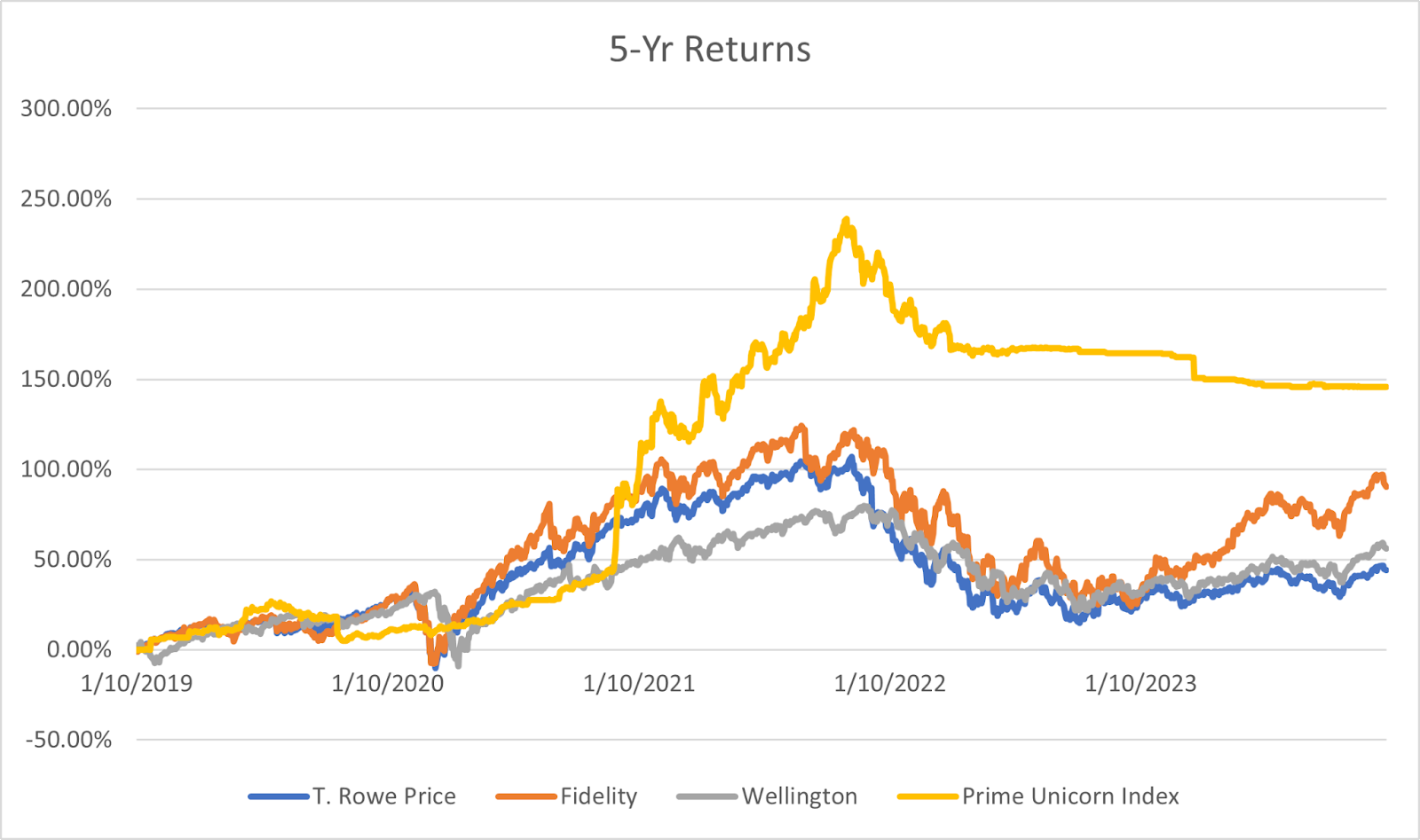

See how a selection of growth funds from each firm has performed against the Prime Unicorn Index below.