GoBrands (DBA: GoPuff), once valued at $13.84 billion by the Prime Unicorn Index, has seen its share price slide nearly 85% in the Index over the past year.

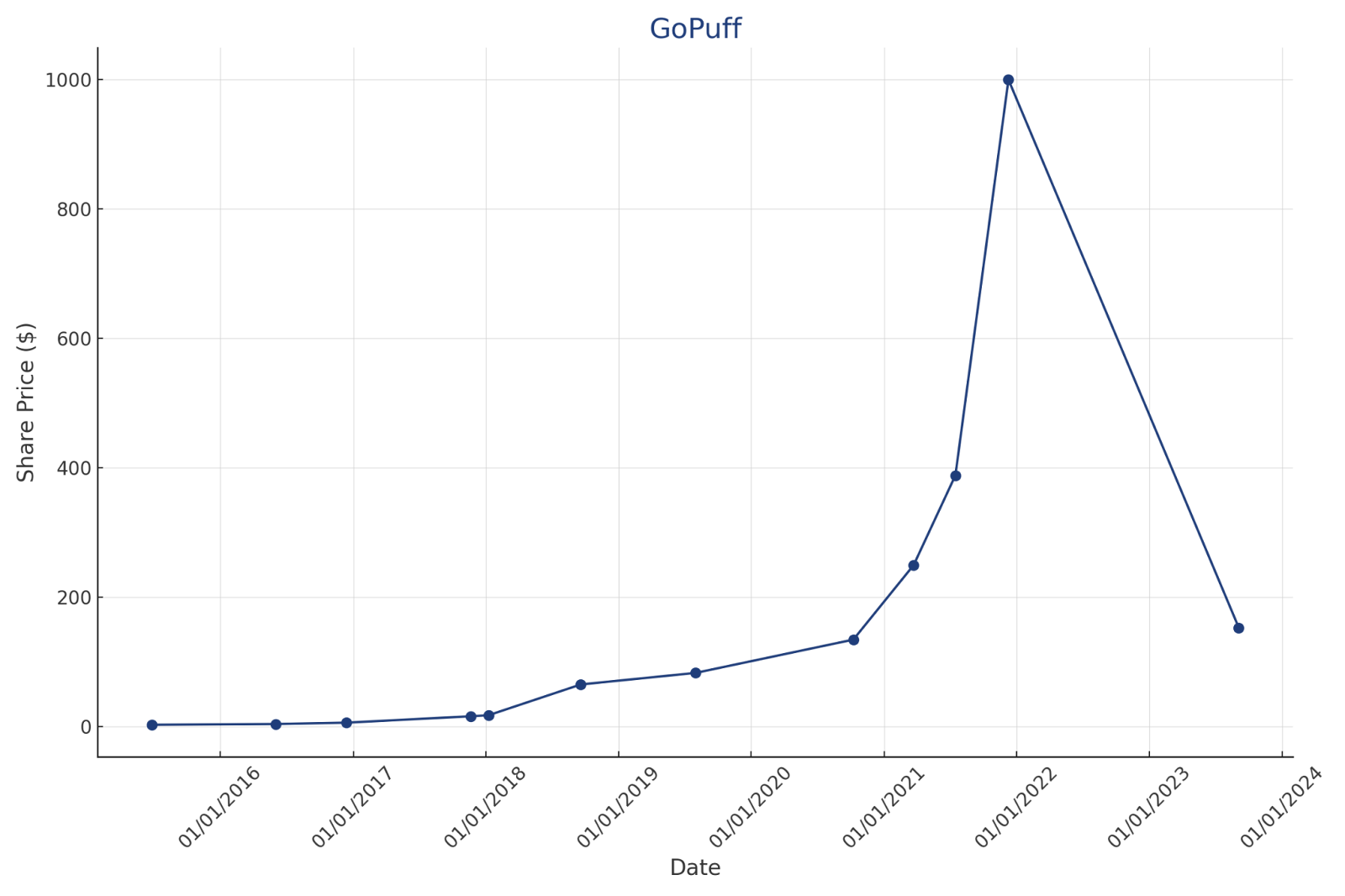

GoPuff last raised a $1 billion Series H round in July 2021 at $388.49 per share, which gave the company a $13.84 billion post-money valuation. Later, in December 2021, the company issued a filing disclosing a Series X preferred share price of $1000, which would have given the company a staggering $35 billion pre-money valuation.

Since then, the company has been marked down in the Prime Unicorn Index due to secondary market transactions. According to Caplight data, GoPuff’s share price in a closed transaction in September 2023 was $153, nearly 85% lower than its disclosed Series X price. This dropped the company’s valuation to $5.45 billion, as calculated by the Prime Unicorn Index.

This significant markdown can partially be explained by GoPuff’s recent struggles, showcased in a recent article by The Information, including burning $400 million in 2023. During the same period, its competitor, Doordash, generated $1.5 billion. Fidelity, one of GoPuff’s investors, marked the company down even lower to a $2 billion valuation.

See how GoPuff has performed below.