The Rise

Carta built itself into an essential tool in the private-markets ecosystem. Founded to manage cap-tables and equity plans for startups and investors, Carta amassed sensitive, private data: investor identities, shareholdings, company valuations, cap tables, and secondary transactions. It became ubiquitous in the venture / startup world.

The Fall: Data Misuse & Reputation Risk

Somewhere along the way, that access came back to bite them. In a Linkedin post in January 2024, Karri Saarinen, co-founder of Linear, a prominent startup, publicly accused Carta of tapping into confidential cap-table data to solicit secondary share sales without consent.

In short, clients trusted Carta with their sensitive information. Carta then allegedly used that information, or permitted its use, for other business lines that created a conflict of interest. As one commentary put it: “Carta’s catastrophe demonstrates the need for data-centric security standards … the startup world must evolve its understanding of data-centric security.” –John Ackerly, Virtru.com.

The client backlash was real. A company whose core value proposition is “secure, trusted equity management” found itself under fire for possibly misusing the very data it was entrusted with.

Falling Out of the Prime Unicorn Index 30

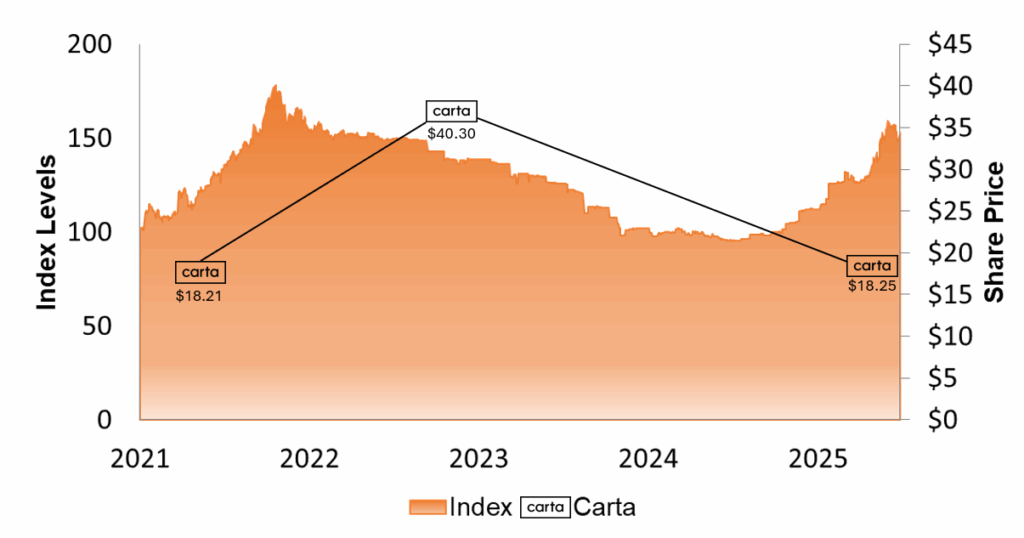

Carta’s decline hasn’t just been reputational, it’s been financial. Once one of the highest-valued private fintech companies in the U.S., Carta’s estimated valuation has dropped sharply. Once ranked 17th in the Prime Unicorn Index 30, Carta now sits at 67th in the full composite index.

That’s not a minor slide. The Prime Unicorn Index 30 tracks the 30 most valuable private U.S. companies and falling out of that top tier signals a significant shift in perceived value and investor confidence. Carta’s estimated valuation has reportedly fallen from roughly $7.3 billion in 2022 to around $3.3 billion after the controversy, a steep decline for a company once viewed as a future IPO candidate.

To be fair, this drop mirrors a broader trend we’ve seen among venture-backed fintech and SaaS companies facing slowing growth and sharper scrutiny around governance.

What It Means Going Forward

Carta’s fall from the top 30 is a cautionary tale for the private-markets ecosystem. Access to confidential data can be a moat, but it can also be a minefield. The company still plays a major role in private-equity infrastructure, but it’s a reminder that valuation isn’t only about growth potential, it’s also about control of risk.

At the Prime Unicorn Index, we continue to monitor valuation shifts like these closely. The reshuffling of our top 30 list, and Carta’s steep fall within it, underscores how market perception can materially influence valuation, even for long-established unicorns.

In Summary

Carta once stood as a fintech powerhouse redefining startup equity management. But in 2024, questions about its use of confidential information erased billions in implied value and pushed it out of the Prime Unicorn 30. In a market where data is currency, Carta’s experience serves as a stark reminder: the line between growth and governance isn’t optional, it’s existential.

Prime Unicorn Index Top 30 vs. Carta