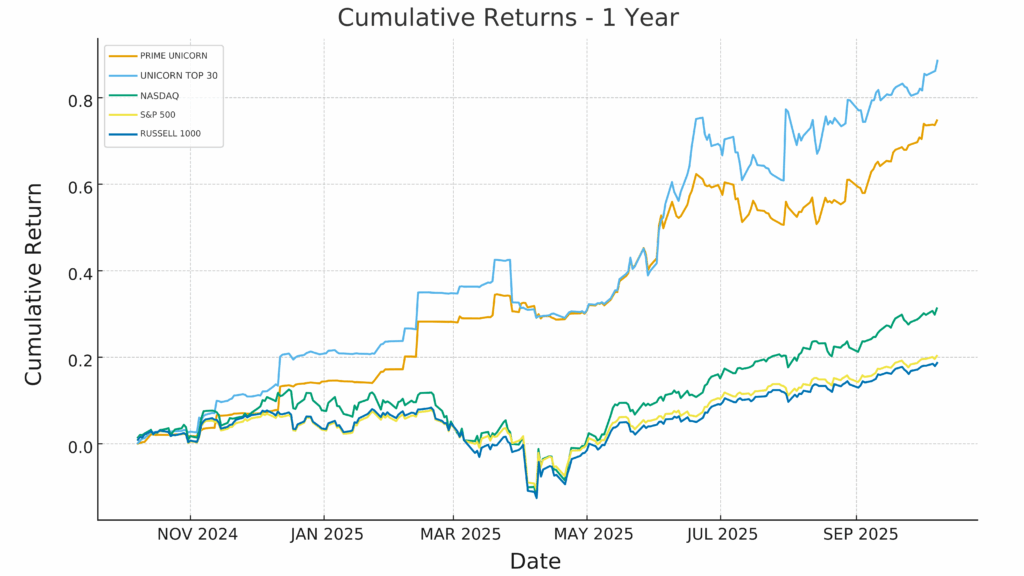

Even amid government uncertainty and broad market weakness, our Prime Unicorn 30 Index continues to demonstrate exceptional resilience, approaching its previous all-time high of 197.45 (set on November 9, 2021) with a recent close of 180.15 on October 8, 2025. This strength underscores how our index remains largely uncorrelated with major benchmarks and offers meaningful diversification potential for investors.

Steady Momentum in a Turbulent Market

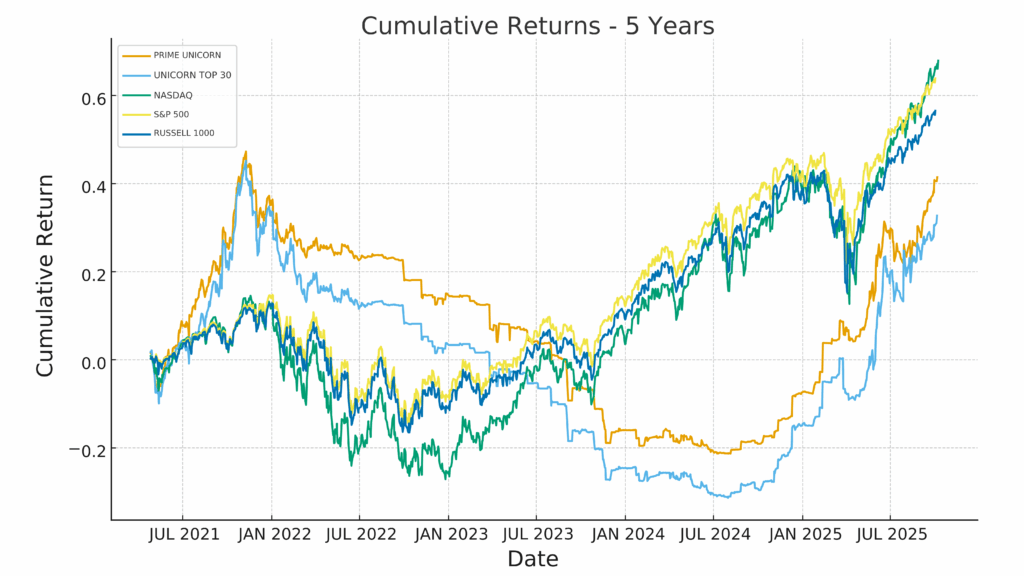

While the NASDAQ, S&P 500, and Russell 1000 have all seen declines in recent weeks, our index has continued to trend higher, maintaining its long-term upward trajectory. The five-year cumulative return line chart highlights this consistency: even through multiple market corrections and policy shocks, the index has steadily rebounded toward record levels. Its one-year performance shows a clear recovery pattern, outperforming broad equity benchmarks through innovation-driven sectors that are less sensitive to macroeconomic cycles.

Low Correlation: A True Diversifier

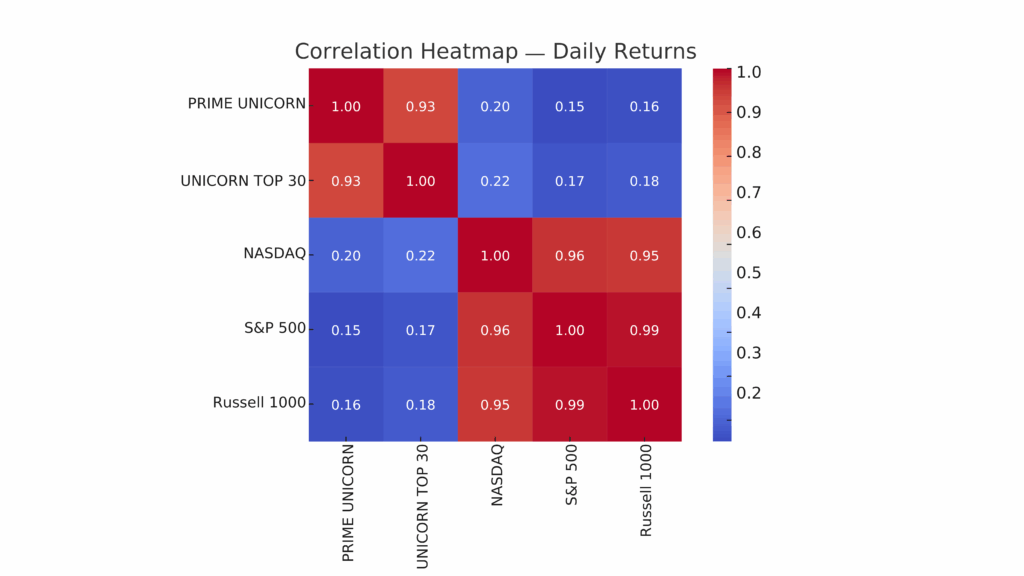

Our latest correlation heat map provides the quantitative proof behind this resilience. Over the past several years, the index has shown only modest correlation with traditional market indices, notably below the typical relationships seen between large-cap equities. This means that while the S&P 500 and NASDAQ tend to move together, our index behaves independently, offering investors a tool to smooth portfolio volatility and enhance risk-adjusted returns through diversification.

Visual Evidence: Rolling Correlations

The accompanying daily return and cumulative line charts above visualize how differently our index reacts to market trends. During major drawdowns in the S&P 500 and NASDAQ, our index often maintained or even gained momentum, reflecting its exposure to alternative growth drivers. Meanwhile, rolling 60-day correlation analysis confirms that its relationship with the broader market remains consistently low, even during periods of heightened volatility, a hallmark of a strong, non-beta-dependent index.

Looking Ahead

As the index approaches its previous record, the data itself tells a compelling story. Its resilience through macroeconomic uncertainty and market drawdowns highlights how the underlying methodology captures structural rather than speculative growth. Going forward, continued tracking and analysis will focus on how the index sustains this performance across varying policies and rate environments. For portfolio strategists and analysts, these results reinforce the index’s potential role as a stabilizing component within multi-asset frameworks, one that behaves independently from traditional benchmarks and provides diversification when it matters most.