In the effervescent world of beverage startups, two companies have been bubbling up to the surface: Olipop and Liquid Death. One is riding a wave of success, its valuation soaring like a perfectly popped cork, while the other might be starting to feel the pressure, its growth more akin to a flat soda. Let’s take a whimsical sip of their financing histories and see who’s truly refreshing investors’ portfolios—and who might be sipping on humble pie.

Olipop: Fizzing to the Top

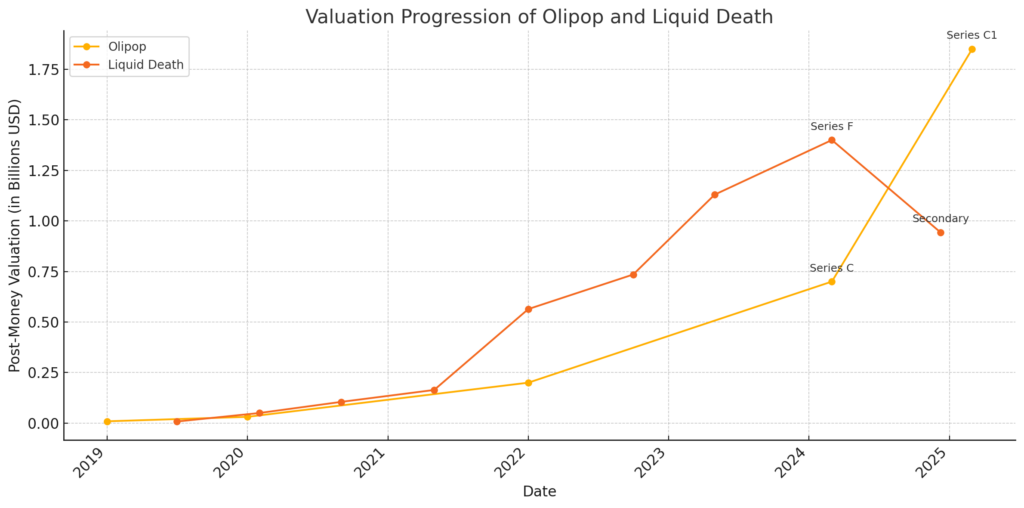

Olipop, the prebiotic soda sensation, burst onto the scene in 2018 with a mission to make soda healthy again. Armed with gut-friendly ingredients and a knack for flavor, this company has been carbonating the market ever since. Their latest milestone? A $50 million Series C funding round, led by J.P. Morgan Private Capital’s Growth Equity Partners, which valued Olipop at a sparkling $1.85 billion. That’s the kind of number that makes you wonder if their cans are secretly filled with liquid gold.

But the fizz doesn’t stop there. Olipop’s sales have been skyrocketing, doubling to $400 million in 2024. And here’s the real kicker: they’ve turned profitable in the same year. In a startup landscape where burning cash is as common as ice in a cooler, Olipop is not just surviving—they’re thriving. With plans to expand their retail footprint and concoct new flavors, Olipop is proving that health-conscious beverages can be both good for you and good for business.

Liquid Death: Still Making Waves, But…

Enter Liquid Death, the punk rock rebel of the beverage world. With its canned mountain water and a marketing strategy that screams “death to plastic,” this brand has been turning heads since day one. Their latest funding haul? A $67 million round, backed by top national distributors and a roster of celebrity investors from entertainment and sports, valuing the company at $1.4 billion. Not a drop in the bucket by any means, but when you compare it to Olipop’s $1.85 billion, it starts to feel like Liquid Death might be running a little low on steam.

Liquid Death: A Valuation That’s Lost Its Edge

Liquid Death, once riding high, has hit some choppy waters. Following a $67 million funding round in 2024 that pegged its valuation at $1.4 billion, the company faced a sobering setback. On December 9, 2024, a secondary transaction on the CapLight Platform—a marketplace for trading private company shares—revealed an implied value drop to $943 million after a direct secondary trade. This nearly $500 million plunge suggests shifting investor confidence or market dynamics at play. With sales reaching $303 million in 2024—solid, but lagging behind Olipop’s growth—Liquid Death’s fizz seems to have flattened. The fallout? During the Q2 2025 Reconstitution, Liquid Death was removed from the Prime Unicorn Index, a clear signal that it no longer met the index’s high bar for unicorn status.

Sales tell a similar story. Liquid Death clocked in at $263 million in retail scanned sales in 2023, climbing to $303 million in 2024. That’s growth, sure—about a 15% bump—but it’s more of a gentle ripple than the tidal wave Olipop’s riding. While their branding remains killer (pun intended), their financials might be starting to feel a tad… dehydrated. Could it be that the hype is cooling off, leaving Liquid Death treading water in a sea of stiffer competition?

Head-to-Head: Who’s Quenching Investors’ Thirst?

Let’s pour these two contenders into the same glass and see how they stack up:

- Valuation: Olipop’s $1.85 billion towers over Liquid Death’s implied sub-$1B. That’s a gap wide enough to fill with a few thousand cases of soda—or water, depending on your preference.

- Sales Growth: Olipop’s sales doubled to $400 million in 2024, while Liquid Death’s crept up to $303 million. One’s a rocket ship; the other’s more of a leisurely paddleboat.

- Profitability: Olipop’s making money hand over fist, while Liquid Death’s profitability remains a mystery—like the last sip in a can you swore was empty.

Olipop is clearly the top dog here, fizzing with momentum and leaving investors buzzing. Liquid Death, while still a formidable player with its edgy vibe and loyal fanbase, seems to be losing some of its sparkle in comparison. It’s not curtains for them yet—$1.4 billion is nothing to sneeze at—but given the recent secondary is at a lower valuation sub- $1B they might need to shake things up to keep pace with Olipop’s relentless rise.

The Future of Beverage Battles: Pop or Flop?

So, where do these two beverage behemoths go from here? Olipop looks poised to keep climbing, its prebiotic prowess and profitability paving the way for more retail domination and flavor innovation. They’re the bubbly belle of the ball, and investors are lining up to take a sip. Liquid Death, meanwhile, might need to dig deeper into their bag of tricks—maybe a new product line or a marketing stunt even wilder than their current playbook—to reignite that early fire. For now, their growth feels more like a slow drip than a gushing fountain.

In this fizzy face-off, Olipop is the one raising a toast, its cans practically clinking with success. Liquid Death? They might be sipping on humble pie—or at least a lukewarm can of their own water—wondering how to recapture the magic. The beverage market is as unpredictable as a shaken soda can, but one thing’s clear: Olipop’s got the winning recipe right now, while Liquid Death might need to find a lifeline to stay afloat.

Valuation Comparison: Olipop vs. Liquid Death